🧐 What is moneylion: cash advance app and How does it work?

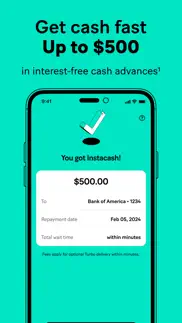

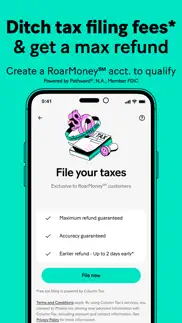

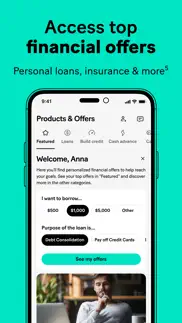

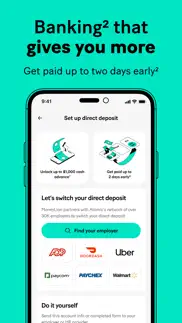

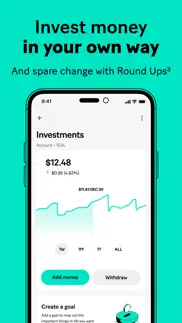

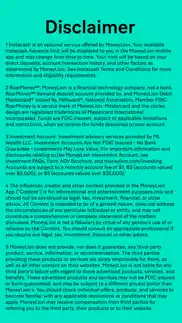

Make better money decisions with MoneyLion. Access mobile banking, personal finance resources & fast cash for extra money when you need it. Discover tools, insights, & offers for every money moment in your life. GET PAID EARLY (UP TO 2 DAYS)² - ROARMONEY BANKING Fast forward to payday with RoarMoney℠ direct deposit. Open a RoarMoney banking account and invest your extra cash with Round Ups³. *Earn up to a $55 bonus⁴ when you join and create a RoarMoney account and link qualifying direct deposits! (Use code: ROARBONUS) QUICK CASH ADVANCE UP TO $500¹ Access up to $500 of your pay, any day with Instacash℠ cash advances. Get money in minutes with no interest, no mandatory fees, & no credit check. Increased limit up to $1,000¹ with qualifying recurring direct deposits. FAST LOAN OFFERS⁵ Need to borrow money? Get matched with personal loan offers from partners on the MoneyLion Marketplace. Compare offers for personal loans, small loans, online loans, savings accounts, & more. CREDIT BUILDER LOAN⁶ Access a Credit Builder loan of up to $1000 & exclusive services with a membership. MoneyLion is not affiliated with other money apps, loan apps, or instant cash advance apps such as Dave, Beem, Self, Varo Bank, Possible Finance, TurboTax, IRS2Go, TaxAct, Earnin, Empower, Cleo, Brigit, or Kikoff 1 Instacash is a 0% APR cash advance service provided by MoneyLion. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. This service has no mandatory fees. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. For a $40 Instacash advance with a Turbo Fee of $4.99, your repayment amount will be $44.99. Generally, your scheduled repayment date will be your next direct deposit date which can range from weekly to monthly depending on your deposit cycle. An Instacash advance is a non-recourse product, not a personal loan, and there is no mandatory minimum or maximum timeframe for repayment; you will not be eligible to request a new advance until your outstanding balance is paid. See Membership Agreement and http://help.moneylion.com for additional terms, conditions and eligibility requirements. Increased Instacash limit with Safety Net requires recurring direct deposit into RoarMoney account. Instacash is an optional service offered by MoneyLion. Terms and eligibility requirements apply. See Instacash Terms and Conditions for more information. 2 With direct deposit. Faster access to funds is based on comparison of a paper check versus electronic Direct Deposit. 3 Round Ups is subject to terms and conditions. This optional service is offered by MoneyLion. You may be required to have certain MoneyLion accounts to use this feature. 4 Referral Promotion is subject to Terms and Conditions. 5 Personal loans in the MoneyLion marketplace you may apply for have repayment terms from 12 months to 84 months. For example, if you receive a $10,000 loan with a 60-month term and a 16.21% APR, your required monthly payment would be $244.30 ($135.09 Principal + $109.21 Interest). Assuming all 60 payments are made on-time, the total amount paid would be $14,657.87. All loan offers on the MoneyLion marketplace require your application and approval by the lender. Depending on the lender, other fees may apply, such as origination fees or late payment fees. See lender's terms and conditions for additional details. You may not qualify for the lowest rates or the highest offer amounts or may not qualify for a loan at all. 6 Credit Builder loans are made by either exempt or state-licensed subsidiaries of MoneyLion Inc. NMLS 1237506

40 Best Finance Apps like MoneyLion: Cash Advance App 🔥 Top Picks for 2024

A guide to the best alternatives for moneylion: cash advance app. What are the top finance apps like moneylion: cash advance app for 2024? Find popular finance like moneylion: cash advance app. Below are the most similar finance apps we found. Discover the top 40 competitors to moneylion: cash advance app.