🧐 What is chime – mobile banking and How does it work?

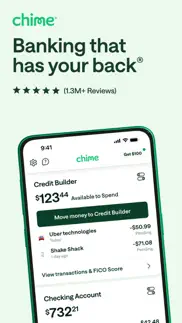

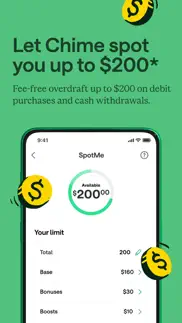

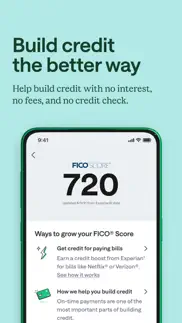

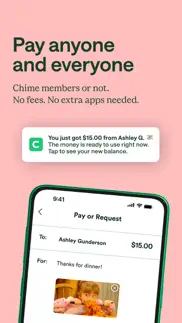

Chime is the banking app that has your back. Keep your money safe with security features, overdraft up to $200 fee-free*, and get paid early with direct deposit^, with no monthly fees. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A.; Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. The Chime Visa® Credit Builder Card is issued by Stride Bank pursuant to a license from Visa U.S.A. Inc. May be used everywhere Visa cards are accepted. TRUSTED BY MILLIONS Stay in control of your money with instant transaction and daily balance alerts. Plus, enable two-factor authentication and block your card in a single tap. OVERDRAFT UP TO $200* When your balance is running low, the last thing you need is an overdraft fee. Eligible members on Chime can overdraft up to $200* on debit card purchases and ATM withdrawals fee-free. NO MONTHLY FEES Chime has no monthly maintenance fees, minimum balance fees, or foreign transaction fees. Plus, access 60k+ fee-free‡ ATMs at locations like Walgreens, 7-Eleven, CVS, and more. GET PAID UP TO 2 DAYS EARLY Get your paycheck up to two days early^ with direct deposit, earlier than you would with some traditional banks. A NEW WAY TO BUILD CREDIT Use Credit Builder¹ to increase your FICO® Score by an average of 30 points² with regular on-time payments. No interest‡, no annual fees, no credit check to apply. PAY ANYONE WITH NO TRANSFER FEES Send money to friends and family fast as a text – with no transfer fees. ––––– *Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions. Only SpotMe eligible members may send boosts. ‡Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. ^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date. ¹Chime Checking Account and $200 qualifying direct deposit required to apply for the secured Chime Credit Builder Visa® Credit Card. See chime.com to learn more. ²Based on a representative study conducted by Experian®, members who made their first purchase with Credit Builder between June 2020 and October 2020 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. ³Based on Bankrate’s 2022 Checking Account and ATM Fee Survey: https://www.bankrate.com/banking/checking/checking-account-survey/ Chime received the highest 2021 Net Promoter Score among competitors in the industry according to Qualtrics®. Address: 101 California Street, Suite 500, San Francisco, CA 94111, United States. No customer support available at HQ. Customer support details available on the website.

40 Best Finance Apps like Chime – Mobile Banking 🔥 Top Picks for 2024

A guide to the best alternatives for chime – mobile banking. What are the top finance apps like chime – mobile banking for 2024? Find popular finance like chime – mobile banking. Below are the most similar finance apps we found. Discover the top 40 competitors to chime – mobile banking.