🧐 What is albert: budgeting and banking and How does it work?

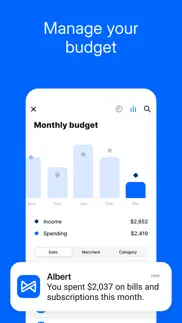

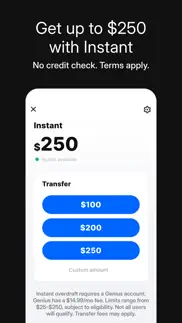

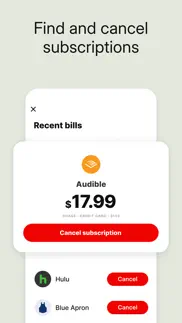

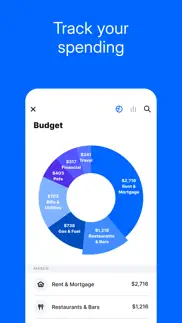

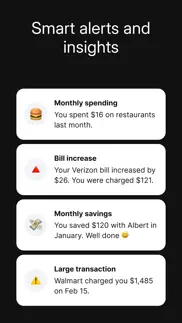

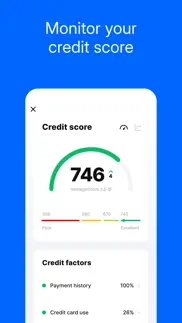

THE SIMPLE WAY TO BUDGET, BANK, SAVE, AND INVEST Save and spend smarter when you manage your money with Albert. Manage your budget and spending across multiple accounts, track subscriptions, get smart alerts to save more and spend less, save and invest automatically, get up to $250 in overdraft coverage, monitor your identity and credit score, and finance experts. Albert is not a bank. See disclosures below. KNOW WHERE YOUR MONEY’S GOING • Manage your monthly budget • Personalized spending insights • Track bills and subscriptions • See all your accounts in one place BANKING WITH GENIUS • Overdraft up to $250 • Get paid up to 2 days early with direct deposit • Earn cash back rewards SAVE SMARTER • Automatic saving • Create and track goals • Earn cash bonuses GUIDED INVESTING • Invest automatically • Buy stocks and ETFs • Managed portfolios PROTECT YOUR MONEY • Identity protection • Credit score monitoring • Real-time alerts DISCLOSURES Banking services provided by Sutton Bank, Member FDIC. Savings with Genius and Albert Savings accounts (together, “Savings”) are held for your benefit at Coastal Community Bank, and Wells Fargo, N.A., Members FDIC, respectively (together with Sutton Bank, the “Deposit Banks”). The Albert Mastercard® debit card is issued by Sutton Bank, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds in Albert Cash and Savings are held in pooled accounts at their respective Deposit Banks and each are FDIC-insured up to $250,000 on a pass-through basis. Your FDIC insurance for each such account is subject to Albert maintaining accurate records, a positive determination by the FDIC as receiver if a Deposit Bank should fail, and with respect to each Deposit Bank the aggregation of all of your deposits held at that Deposit Bank. Albert Investing accounts are not FDIC insured or bank guaranteed and involve the risk of loss. The Albert Subscription costs up to $14.99 per month. Try it for 30 days before you're charged. The Albert Subscription fee will auto-renew until canceled or your Albert account is closed. Cancel any time in the app. The Albert Subscription does not include all Albert features. See Terms for more details. Genius, which includes Albert Cash, Savings with Genius, and all features offered by the Albert Subscription, has a maintenance fee that costs $14.99/month when billed monthly, or $149.88 annually if available. You’ll be charged 30 days after signing up. Deactivate Genius or close your Albert account any time in the app. With Instant overdraft coverage eligible members can overdraw their Albert Cash account for debit card purchases, ATM withdrawals, and transfers. Limits start at $25, are reevaluated on an ongoing basis, and are subject to eligibility requirements based on your linked bank account activity, and other factors. Fast transfer, ATM and other fees may apply. Brokerage services provided by Albert Securities, member FINRA/SIPC. Investment advisory services provided by Albert Investments. Investing accounts are not FDIC insured or bank guaranteed. Investing involves the risk of loss. More info at albrt.co/disclosures. Credit score calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore 3.0.

40 Best Finance Apps like Albert: Budgeting and Banking 🔥 Top Picks for 2024

A guide to the best alternatives for albert: budgeting and banking. What are the top finance apps like albert: budgeting and banking for 2024? Find popular finance like albert: budgeting and banking. Below are the most similar finance apps we found. Discover the top 40 competitors to albert: budgeting and banking.