🧐 What is debt to income calculator and How does it work?

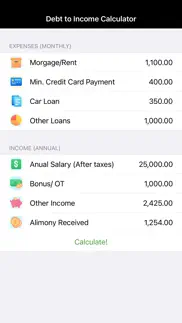

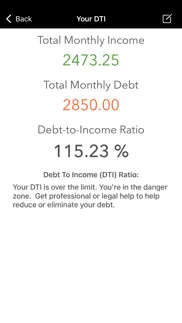

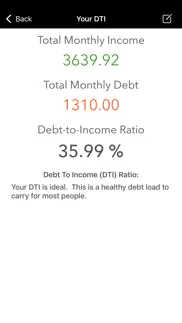

This app was designed to aid you to determine how much debt you could afford compared to your existing income. This app will tell you the ratio between your current income and debt. What is a debt-to-income ratio? Debt to income ratio (DTI) is the amount of your total monthly bills divided by how much money you make a month. It allows lenders to determine the likelihood that you would be able to repay a loan. For instance, if you pay $2,000 a month for a mortgage, $300 a month for an auto loan and $700 a month for the rest of your bills, you have a total monthly debt of $3,000. If your gross monthly income is $7,000, you divide that into the debt ($3,000 / 7,000) and your debt-to-income ratio is 42.8%. Most lenders would like your debt-to-income ratio to be under 35%. However, you can receive a qualified mortgage with as high as a 43% debt-to-income ratio. According to the Federal Reserve Board, the household debt service payments and financial obligations as a percentage of disposable personal income was 10.1% in the first quarter of 2017. That is down from the high of 18.1 in December of 2009. The ratio is best figured on a monthly basis. For example, if your monthly take-home pay is $2,000 and you pay $400 per month in debt payment for loans and credit cards, your debt-to-income ratio is 20 percent ($400 divided by $2,000 = .20). Put another way, the ratio is a percent of your income that is pre-promised to debt payments. If your ratio is 40%, that means you have pre-promised 40% of your future income to pay debts. Why Debt-To-Income Ratio % Matters While there is no law establishing a definitive debt-to-income ratio that requires lenders to make a loan, there are some accepted standards, especially as it regard federal home loans. For example, if you qualify for a VA loan, the department of Veteran Affairs guidelines suggest a 41% debt-to-income ratio. FHA loans will allow for a ratio of 43%. It is possible to get a VA or FHA loan with a higher ratio, but only when there compensating factors. The ratio needed for conventional loans varies, depending on the lending institution. Most banks rely on the 43% figure for debt-to-income, but it could be as high as 50%, depending on factors like income and credit card debt. Larger lenders, with large assets, are more likely to accept consumers with a high income-to-debt ratio, but only if they have a personal relationship with the customer or believe there is enough income to cover all debts. Remember, evidence shows that the higher the ratio, the more likely the borrower is going to have problems paying.

40 Best Finance Apps like Debt To Income Calculator 🔥 Top Picks for 2024

A guide to the best alternatives for debt to income calculator. What are the top finance apps like debt to income calculator for 2024? Find popular finance like debt to income calculator. Below are the most similar finance apps we found. Discover the top 40 competitors to debt to income calculator.