🧐 What is withholding calc and How does it work?

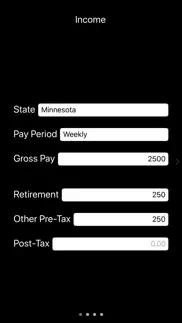

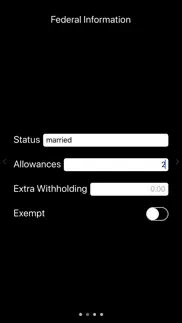

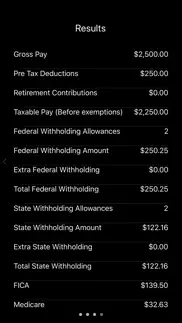

Tax time is coming again! Will you be ready for it? WithholdingCalc is an ad-free estimator for your pay check. Input your pay check gross pay, pre-tax deductions (insurance, 401k, etc.), filing status, state, and withholding allowances from your W-4 and get an estimate of how much of each of your pay checks is going to the government, and how much is going into your pocket. You can see how to optimize your monthly budget and make sure you've had enough taxes held back for tax time! Want to get even more advanced? Switch over to the advanced view and you can enter extra withholding amounts for both Federal and State taxes, and separate filing status and withholding allowance amounts for your state to get an even more accurate picture of your tax withholding. WithholdingCalc lets you easily manipulate the numbers from your W-4 form to help you get an accurate picture of your budget and how much tax withholding you will have accumulated for tax season. WithholdingCalc is based on current 2018 tax rates for most federal and state tax rates for the 41 states that have income tax plus the District of Columbia and Puerto Rico. We will update Withholding Calc as further tax rate changes come in. WithholdingCalc uses an annualized method for computing taxes for most jurisdictions. This means that the total tax withholding that it computes may be slightly different from what your employer computes. Generally the two numbers will agree to within a few cents. If they don't, please use our contact form to let us know and we'll investigate it! With the updates some of the 2018 tax brackets now in place, we'll be adding in some of the features we've been working on, like the option to compute your pay check based on an hourly pay rate (with or without overtime pay), calculations for places where there are local taxes as well as state taxes, and more accurate options for states like Arizona which use flat percentage options for withholding instead of a withholding allowance amount. The 2018 IRS tax brackets aren't available yet, but we'll be adding them as soon as they are. WithholdingCalc is not endorsed by any taxing authority, including the Department of the Treasury or the Internal Revenue Service (They want you to give them too much money :) ).

40 Best Finance Apps like Withholding Calc 🔥 Top Picks for 2024

A guide to the best alternatives for withholding calc. What are the top finance apps like withholding calc for 2024? Find popular finance like withholding calc. Below are the most similar finance apps we found. Discover the top 40 competitors to withholding calc.